Tax Credit for Tutoring

Unlock a comprehensive overview of your 2025 account by seamlessly logging into your parent profile.

Should you encounter any challenges in accessing your documentation, fret not! Reach out to us, and we'll promptly dispatch a detailed statement encompassing all the services availed throughout the year.

For additional assistance, contact our dedicated customer service at sacsat@successcolaire.ca.

In Québec, certain tutoring fees may be eligible for the provincial tax credit for children’s activities, provided that the services are part of a structured educational activity and meet the criteria set by Revenu Québec.

For the 2025 tax year, you may be eligible if:

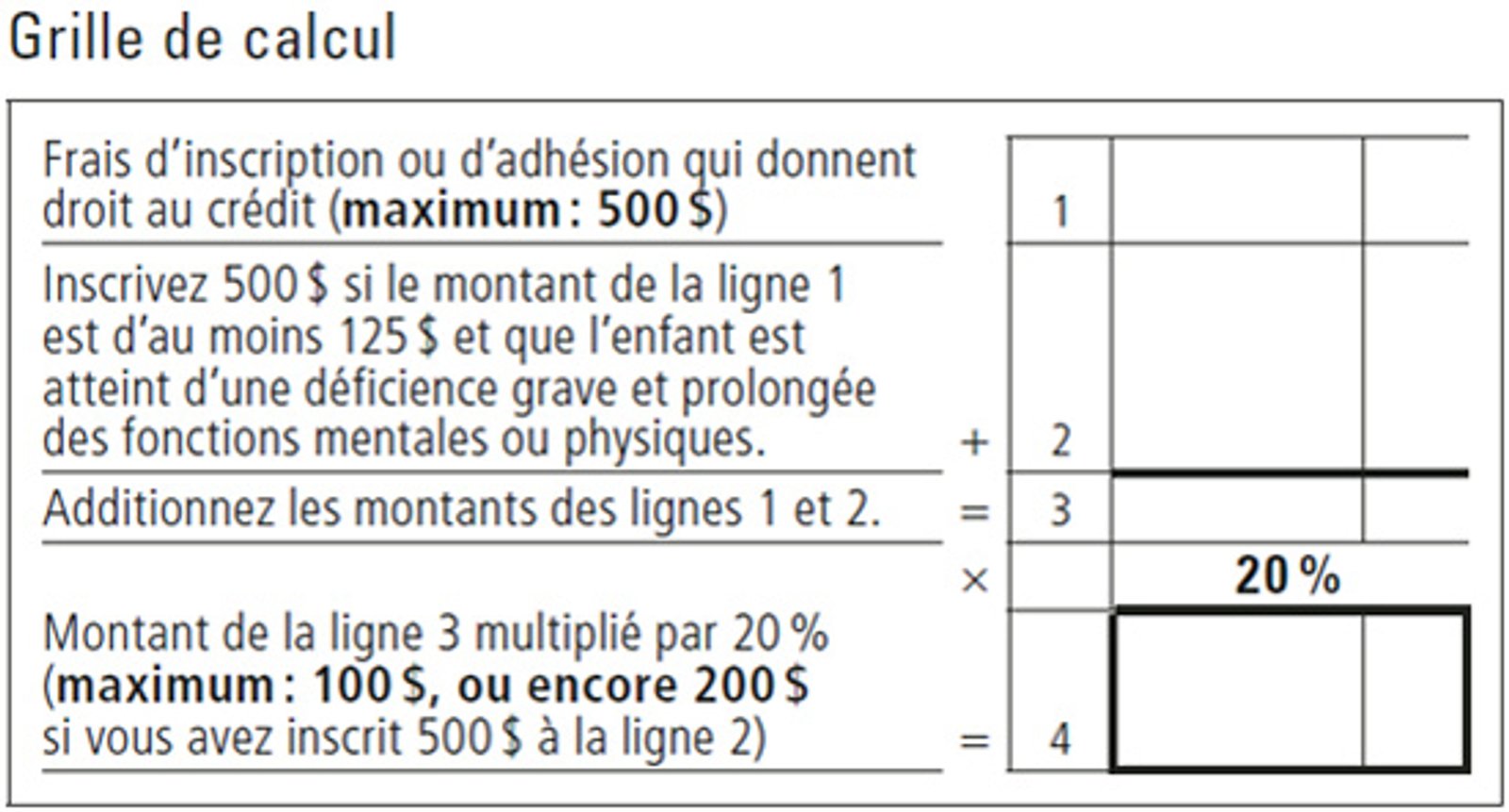

If these conditions are met, you may qualify for a refundable tax credit equal to 20% of eligible expenses, up to $500 per child, for a maximum credit of $100 per child.

Eligible tutoring expenses must be reported on line 462 of your Québec income tax return, up to the $500 limit per child.

Thanks to these tips, you could benefit from a tax credit of $100.00!

If your child has learning difficulties or a mental impairment and receives tutoring services, you may be eligible for a tax credit for medical expenses.

⚠️ Important: A physician or a recognized medical professional must certify in writing that these services are medically necessary.

Enter the eligible amount on line 381 (medical expenses) of your Québec income tax return.

Enter the eligible amount on line 33099 (medical expenses) of your federal income tax return.

Note

The provider of the tutoring services must issue a receipt for the services rendered.

If the services are provided by an individual, the receipt must include their Social Insurance Number (SIN).

For additional details, explore these informative websites: